underapplied overhead journal entry|underapplied or overapplied overhead : Pilipinas The adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust .

Família sacana tufos br. 95 subscribers. View in Telegram. Preview channel. If you have Telegram, you can view and join Família sacana tufos br .

PH0 · underapplied or overapplied overhead

PH1 · journal entry for underallocated overhead

PH2 · how to calculate underapplied overhead

PH3 · how to calculate applied overhead

PH4 · cost accounting journal entries examples

PH5 · calculate over or underapplied overhead

PH6 · applied overhead journal entry

PH7 · Iba pa

In order to ensure the accuracy of LOTTO 6/49 draw results across all regions in Canada, there may be a delay in reporting winning numbers. LOTTO 6/49 & EXTRA Past Winning Numbers. 4358572 View Prize Breakdown. Saturday, August 31, 2024 CLASSIC DRAW. 7; 24; 25; 34; 43; 44; Bonus 13; GOLD BALL DRAW

underapplied overhead journal entry*******On the other hand, the company can make the journal entry for underapplied overhead by debiting the cost of goods sold account and crediting the manufacturing overhead account. This journal entry is the opposite of the overapplied overhead as the remaining balance of the . Tingnan ang higit pa

As the manufacturing overhead costs that are applied to the production are based on the estimation, it rarely is equal to the actual overhead cost that really occurs during the period. Likewise, the company usually . Tingnan ang higit paFor another example, assuming the actual overhead cost that has occurred during the period is $11,000 instead while the applied overhead cost is $10,000, the same as . Tingnan ang higit pa

The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting . Tingnan ang higit pa

For example, on December 31, the company ABC which is a manufacturing company finds out that it has incurred the actual overhead cost of $9,500 during the accounting . Tingnan ang higit paThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust . If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in .Learn how to reconcile the underapplied or overapplied overhead journal entry based on the debit or credit balance of manufacturing overhead at the end of the accounting .Underapplied Overhead. MyExceLab. A more likely outcome is that the applied overhead will not equal the actual overhead. The following graphic shows a case where $100,000 .

underapplied or overapplied overheadThe adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0. If the overhead was overapplied, and the actual overhead was $248,000 and the applied . This video shows how to record a journal entry to dispose of an underapplied manufacturing overhead balance, either by transferring the balance to .Solution. The total overhead incurred is the total of: The total overhead applied is $209,040, which is calculated as: $33.50/direct labor hours × 6,240 direct labor hours. .After this journal entry, the balance of manufacturing overhead remains $500 (8,500 – 8,000) on the debit side of the ledger. This a sign of underapplied overhead; though .Where the overhead is overapplied the following journal entry is made: After passing one of these journal entries, cost of goods sold is adjusted. Consequently cost of goods . A credit of $10,000 is needed to balance the T-journal entry. . The sum of all these is equal to the $10,000 underapplied overhead. The adjusting entry to compensate for the underapplied .8,000. Manufacturing overhead. 8,000. After this journal entry, the balance of manufacturing overhead remains $500 (8,500 – 8,000) on the debit side of the ledger. This a sign of underapplied overhead; though whether it is under or overapplied overhead, it will be shown at the end of the accounting period.underapplied overhead journal entry underapplied or overapplied overhead Underapplied overhead 13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). The T-account that follows provides an example of underapplied overhead. . For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the . When each job and job order cost sheet have been completed, an entry is made to transfer the total cost from the work in process inventory to the finished goods inventory. The total cost of the product for Job MAC001 is $931 $ 931 and the entry is: Figure 4.7.8 4.7. 8: WIP inventory to recognize job completion.

Disposition of over or underapplied overhead balance. There are two ways to dispose off this balance. Closing out the balance in manufacturing overhead into cost of goods sold and closing it to work in process WIP, finished goods and cogs account to cost of goods sold is simpler that the allocation method.

Question: Determine whether there is over or underapplied overhead. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. . rate based on direct labor cost 228,000 381,000 33,000 98,000 138,000 1,580,000 75% Determine whether there is over or underapplied overhead. Prepare the journal entry . Cost of goods sold $950,000 / $1,300,000 = 73.08% X $150,000 = $109,620 underapplied in cost of goods sold. We know how much overhead has been underapplied in each account, so we now must adjust each of the account. When overhead is underapplied, there is not enough overhead in each of the accounts. This video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Manufacturers apply overhead using a predetermined o.underapplied overhead journal entryThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods .Some companies do this monthly; others do it quarterly or annually. The journal entry to transfer Creative Printers’ overhead balance to Cost of Goods Sold for the month of July is as follows: . The entry to correct under-applied overhead, using cost of goods sold, would be (XX represents the amount of under-applied overheard or the .The adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods .4.4 Compute a Predetermined Overhead Rate and Apply Overhead to Production; 4.5 Compute the Cost of a Job Using Job Order Costing; 4.6 Determine and Dispose of Underapplied or Overapplied Overhead; 4.7 Prepare Journal Entries for a Job Order Cost System; 4.8 Explain How a Job Order Cost System Applies to a Nonmanufacturing .

Valle Builders 2-a. Determine whether overhead is overapplied or underapplied. 2-b. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Determine whether overhead is overapplied or underapplied.

Accounting questions and answers. 4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) Answer is not complete.4.6 Determine and Dispose of Underapplied or Overapplied Overhead; 4.7 Prepare Journal Entries for a Job Order Cost System; 4.8 Explain How a Job Order Cost System Applies to a Nonmanufacturing . You will learn in Determine and Disposed of Underapplied or Overapplied Overhead how to adjust for the difference between the .

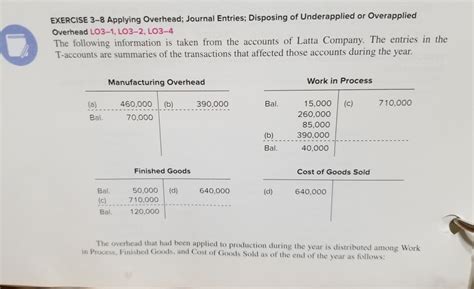

To adjust for over or under applied overhead, you need to make a closing entry that transfers the balance of the overhead account to the cost of goods sold account. The cost of goods sold account .Expert-verified. 1) in manufacturing overhead $390,000 is the applied overhead in WIP inventory $390,000 is the applied overhead and $710,000 is the goods completed and transferred to finished goods in f .. EXERCISE 3-8 Applying overhead; Journal Entries; Disposing of Underapplied or Overapplied Overhead LO3-1, LO3-2, LO 3-4 The .

Watch porn sex movies free. Hardcore XXX sex clips & adult porn videos available to stream or download in HD. Hot porn and sexy naked girls on Pornhub.

underapplied overhead journal entry|underapplied or overapplied overhead